7 Revolutionary Benefits of Using a 990 Finder to Elevate Your Nonprofit’s Impact

Are you leveraging a 990 finder to uncover the hidden treasures of nonprofit intelligence that could transform your organization’s fundraising strategy? The strategic use of IRS data has become the secret weapon of successful nonprofit leaders who understand that transparency isn’t just about compliance—it’s about competitive advantage.

Demystifying the 990 Finder: Your Gateway to Nonprofit Intelligence

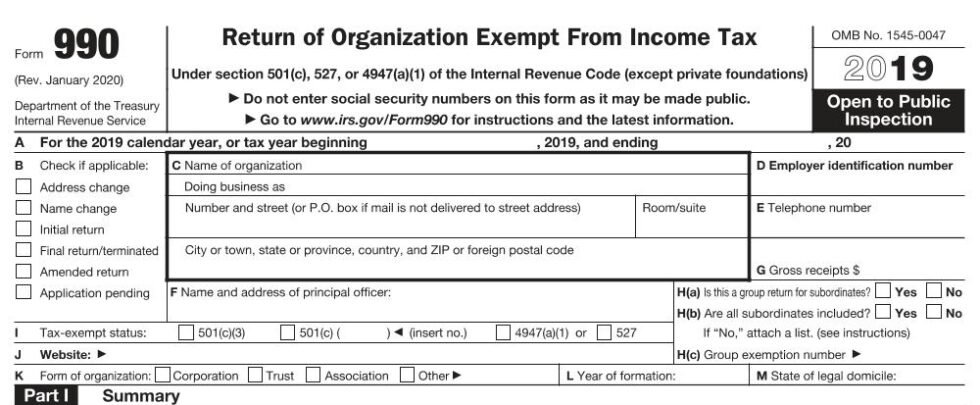

The nonprofit sector operates in an ecosystem where transparency isn’t optional—it’s essential. A 990 finder serves as your digital compass through the vast ocean of financial disclosures that nonprofits are required to make public. This powerful tool provides immediate access to Form 990 documents filed by nonprofit organizations, revealing critical insights about their financial health, programmatic effectiveness, and organizational governance.

Many nonprofit leaders mistakenly view Form 990 as merely a tax compliance obligation rather than recognizing it as a strategic asset. This fundamental misunderstanding puts them at a significant disadvantage in today’s data-driven philanthropic landscape.

“The 990 finder has become indispensable for modern nonprofit strategy,” explains Maria Gonzalez, Executive Director of Community Forward Initiative. “Organizations that ignore this resource are essentially operating blindfolded in an increasingly competitive funding environment.”

Why Your Nonprofit Cannot Afford to Ignore the Tax Document Revolution

1. Unmasking Your Competition’s Financial Strategy

The most strategic nonprofit leaders regularly use a 990 finder to decode their competitors’ financial playbooks. By analyzing the Form 990s of similar organizations, you gain unprecedented visibility into:

- Executive compensation benchmarks specific to your niche

- Program-to-administrative expense ratios that funders expect

- Fundraising efficiency metrics that set industry standards

- Revenue diversification strategies that successful organizations employ

This competitive intelligence gathered through Form 990 analysis enables you to position your organization advantageously in grant applications, donor presentations, and board discussions. Rather than making assumptions about industry norms, you can confidently reference concrete data points.

“I was shocked to discover through tax document research that our primary competitor was allocating three times our budget to digital fundraising—and seeing exponential returns,” admits Jonathan Park, Development Director at Urban Youth Alliance. “This discovery prompted us to restructure our entire outreach strategy.”

2. Transforming Donor Relationships Through Radical Transparency

Today’s donors expect unprecedented transparency before making significant gifts. A 990 finder empowers both your organization and potential supporters to conduct thorough due diligence.

When you proactively share insights from your tax document research, you demonstrate a commitment to accountability that resonates powerfully with major donors. This approach transforms the typical donor relationship from transactional to collaborative.

Consider creating a dedicated section on your website that contextualizes your Form 990 data alongside industry benchmarks obtained through a 990 finder. This transparent approach addresses donor questions before they arise and establishes your organization as exceptionally forthright.

3. Revolutionizing Your Grant Strategy With Data-Backed Proposals

Foundation program officers are increasingly using a 990 finder to evaluate potential grantees before they even submit applications. Smart nonprofit leaders are turning this practice to their advantage.

By utilizing nonprofit research databases to analyze a foundation’s previous grant recipients, you can craft proposals that align precisely with their demonstrated funding priorities—not just their stated ones. This data-informed approach significantly increases your success rate with institutional funders.

“After analyzing the last three years of a foundation’s grants using a 990 finder, we completely rewrote our proposal to emphasize capacity building rather than program expansion,” shares Amara Johnson, Grants Manager at Community Health Partners. “The result was a grant award three times larger than our initial request.”

How Financial Document Analysis Transforms Internal Strategy and Governance

4. Reimagining Board Oversight Through Comparative Analysis

Nonprofit boards often struggle to evaluate organizational performance without appropriate context. A 990 finder solves this problem by providing comparative data that illuminates your organization’s relative strengths and weaknesses.

Forward-thinking organizations are now incorporating nonprofit financial analysis into their board orientation process and regular governance discussions. This practice helps board members fulfill their fiduciary responsibilities more effectively and ask more insightful questions.

“Our quarterly board meetings were transformed when we began presenting competitive analysis from our 990 finder research,” notes Robert Chen, Board Chair at Environmental Justice Coalition. “Conversations shifted from reactive to strategic, focusing on long-term financial sustainability rather than short-term fundraising crises.”

5. Shattering Compensation Myths With Hard Data

Executive compensation remains one of the most challenging aspects of nonprofit management. Traditional salary surveys often lack the specificity needed for meaningful decision-making, especially for specialized organizations.

A 990 finder provides granular compensation data for comparable organizations in your specific subsector, geographic region, and budget range. This precision enables more confident compensation decisions that can be readily justified to stakeholders.

When the Children’s Literacy Foundation needed to hire a new Executive Director, their search committee used a 990 finder to establish a competitive salary range based on organizations with similar missions and budgets. This data-driven approach helped them secure top talent while maintaining appropriate stewardship of donor funds.

Leveraging Financial Research for Marketing and Fundraising Excellence

6. Crafting Irresistible Impact Narratives Through Comparative Advantage

The most compelling fundraising communications highlight your organization’s distinctive impact relative to similar nonprofits. A 990 finder enables you to identify and articulate your comparative advantages with credibility.

By comparing program expense ratios, fundraising efficiency, and revenue growth rates through Form 990 analysis, you can isolate the metrics where your organization truly excels. These data points become powerful elements in your case for support.

“After discovering through our 990 finder that our program delivery costs were 23% lower than similar organizations, we featured this efficiency metric prominently in our annual appeal,” explains Sophia Rodriguez, Communications Director at Veterans Support Network. “Donation response rates increased by 37% compared to the previous year.”

For organizations struggling with certain metrics, nonprofit financial analysis can reveal improvement trends that tell a compelling story of organizational growth and learning—often more persuasive than absolute numbers alone.

7. Revolutionizing Your Development Strategy Through Donor Prospect Research

Sophisticated fundraisers use a 990 finder not just to analyze nonprofit organizations but also to research private foundations and donor-advised funds that might support their work.

Form 990-PF documents accessed through tax document search tools reveal crucial information about a foundation’s:

- Typical grant size and distribution patterns

- Trustee affiliations and potential connection points

- Investment philosophy and approach to philanthropic capital

- Geographic and programmatic priorities

This intelligence allows you to tailor your outreach strategies and funding requests with remarkable precision, dramatically improving your success rates with institutional funders.

Overcoming Common Challenges When Implementing a 990 Finder Strategy

While nonprofit document analysis offers extraordinary benefits, many organizations encounter obstacles when attempting to integrate these tools into their operations. These challenges include:

- Data interpretation complexity: Financial information without proper context can lead to misinterpretations.

- Information lag: Form 990s are typically filed several months after a fiscal year ends, meaning the data may not reflect current conditions.

- Resource constraints: Smaller organizations often lack dedicated staff time for comprehensive analysis.

- Technical expertise gaps: Many nonprofit professionals have limited training in financial analysis.

To overcome these barriers, consider partnering with specialized consultants through platforms like nonprofitfreelancers.com that connect nonprofits with experts in 990 finder implementation. These professionals can help establish sustainable processes for ongoing competitive intelligence gathering.

Future Trends: The Evolving Role of Tax Document Analysis in Nonprofit Strategy

The strategic value of a 990 finder continues to grow as advances in data analytics and artificial intelligence make increasingly sophisticated analyses possible. Forward-thinking nonprofit leaders should prepare for these emerging developments:

- Predictive modeling: Using historical Form 990 data to forecast fundraising potential and financial risks

- Automated benchmarking: Real-time performance comparisons against peer organizations

- Integrated compliance alerting: Proactive identification of potential reporting issues

- Donor-facing transparency tools: Interactive platforms that allow supporters to explore your financial data

Organizations that establish robust 990 finder practices now will be better positioned to capitalize on these innovations as they emerge.

Conclusion: Transform Your Nonprofit Through Strategic Financial Research

In today’s data-saturated philanthropic landscape, intuition and anecdotal evidence are no longer sufficient foundations for strategic decisions. The 990 finder has emerged as an essential tool for nonprofit leaders committed to evidence-based management and maximum mission impact.

By integrating 990 finder analysis into your strategic planning, governance, fundraising, and marketing processes, you position your organization for sustainable growth in an increasingly competitive sector. The transparency this approach fosters builds trust with donors, regulators, and the communities you serve.

The organizations that will thrive in the next decade of nonprofit evolution will be those that embrace radical transparency, competitive intelligence, and data-informed decision-making. The 990 finder stands at the intersection of all three of these critical trends.

Will your organization lead this transformation, or be left behind?

Why NonprofitFreelancers.com Is Your Essential Next Step

After understanding the transformative potential of a 990 finder for your organization, the next logical question is: who can help you implement these strategies effectively? NonprofitFreelancers.com stands as the premier destination for connecting mission-driven organizations with specialized talent who understand the unique challenges of the nonprofit sector. Their vetted network includes financial analysts who specialize in Form 990 interpretation, development consultants who can translate financial insights into compelling fundraising narratives, and strategic planners who help integrate competitive intelligence into your organizational roadmap. Unlike generic freelance platforms, NonprofitFreelancers.com focuses exclusively on the nonprofit ecosystem, ensuring that every consultant understands the delicate balance between mission impact and financial sustainability. Don’t leave your 990 finder insights gathering dust—visit NonprofitFreelancers.com today to connect with professionals who can help you transform raw data into actionable strategies that drive measurable results for your mission.

References

- National Council of Nonprofits. “Form 990 Policy Review.” https://www.councilofnonprofits.org/tools-resources/form-990-policies

- GuideStar by Candid. “The Power of Transparency.” https://www.guidestar.org/Articles.aspx?category=resources

- Propel Nonprofits. “Financial Management and Oversight.” https://www.propelnonprofits.org/resources/financial-management/

- Foundation Center. “Foundation Transparency: What Nonprofits Want.” https://foundationcenter.org/gain-knowledge/research

- BoardSource. “Leading with Intent: Board Governance Practices.” https://boardsource.org/research-critical-issues/