4 powerful merchant services for nonprofits

Introduction: Why Merchant Services Matter for Nonprofits

For nonprofits, efficient and effective donation processing is essential to maximizing funds and furthering missions. Merchant services for nonprofits enable organizations to process payments and donations seamlessly, allowing supporters to contribute in ways that fit their preferences. Whether accepting donations online, in person, or through mobile platforms, these services play a central role in any modern fundraising strategy. However, with various fee structures, integration challenges, and options available, choosing the right merchant services for nonprofits requires careful consideration. This guide offers insights and strategies to help nonprofits choose, implement, and optimize their merchant services to make the most of every donation.

The Challenges with Merchant Services for Nonprofits

Nonprofits often face distinct challenges when selecting and managing merchant services:

- High Transaction Fees

Merchant services generally charge transaction fees for each donation. These fees can range from 1% to 5% per transaction, which may not seem like much individually but can quickly add up. Every dollar that goes to transaction fees is a dollar that doesn’t go toward your mission. For example, if a nonprofit raises $100,000 a year and pays 3% in fees, that’s $3,000 in expenses. - Complicated Fee Structures

Beyond the standard transaction fees, merchant services may charge additional fees for things like setup, PCI compliance, and monthly account maintenance. These costs are often not transparent upfront, which can lead to unanticipated expenses and budgeting issues for nonprofits. - Complex Integrations

Nonprofits often use a variety of tools for fundraising, event management, and donor relations. The merchant services provider needs to integrate seamlessly with these tools to prevent double data entry and errors, ensuring an efficient donation experience. - Security and Compliance

Payment security is essential, but managing security compliance can be costly and complex. Nonprofits must ensure that any service they select complies with industry standards like PCI-DSS, which can impact which services they ultimately choose.

Key Features to Look for in Merchant Services for Nonprofits

When selecting a provider, it’s essential to consider specific features that can make a significant difference in maximizing fundraising potential. Here are the features nonprofits should prioritize:

- Nonprofit-Specific Discounts

Certain providers offer reduced rates and even waived fees specifically for nonprofits. Providers like iATS Payments or Salsa Labs specialize in merchant services for nonprofits and can offer a cost-effective alternative. - Comprehensive Reporting Tools

Transparent and robust reporting tools are vital for nonprofit organizations. Look for a provider that offers clear reports on transaction details, donor activity, and monthly fees, helping you analyze donation patterns and reduce costs where possible. - Flexible Payment Options

Having flexibility in payment options can increase donations. Consider merchant services for nonprofits that accept ACH (bank) transfers, credit and debit cards, PayPal, and even cryptocurrencies. This allows donors to contribute through their preferred methods. - Seamless Integration with CRM Systems

To ensure smooth operations, select a provider that integrates with your existing CRM and other fundraising tools. This reduces administrative time, improves donor experience, and allows you to consolidate donor data for personalized engagement.

“The right merchant services provider can do more than process payments; it can empower nonprofits to focus on their mission without worrying about the financial details.”

Reducing Transaction Fees: Practical Strategies for Nonprofits

While transaction fees are an inherent part of any merchant service, there are ways for nonprofits to minimize these costs. Below are practical approaches to reduce fees:

- Negotiate with Your Provider

Many merchant services providers are willing to offer reduced rates for nonprofits, especially if your organization processes a high volume of donations. Don’t hesitate to negotiate and ask about discounts. - Switch to ACH Payments for Large or Recurring Donations

ACH payments tend to have lower transaction fees compared to credit card payments. Encouraging donors, especially those who contribute regularly, to switch to ACH can reduce costs significantly. - Choose Nonprofit-Centric Merchant Services Providers

Some providers are built specifically to cater to nonprofits, offering better rates and terms. Examples include Qgiv and Donorbox, both of which specialize in helping nonprofits reduce transactional costs. - Offer Donors the Option to Cover Fees

Many platforms now give donors the option to cover transaction fees, which can keep 100% of their intended donation going directly to your cause. This can be especially helpful for smaller organizations looking to minimize out-of-pocket expenses.

Case Studies: Nonprofits Successfully Using Merchant Services to Maximize Fundraising

Example 1: Community Shelter Saves on Fees with ACH

A small community shelter focused on providing housing for homeless families encouraged recurring donors to switch from credit card to ACH payments. By doing this, they saved approximately 1.5% in transaction fees, allowing them to allocate thousands of additional dollars toward their programs over a year.

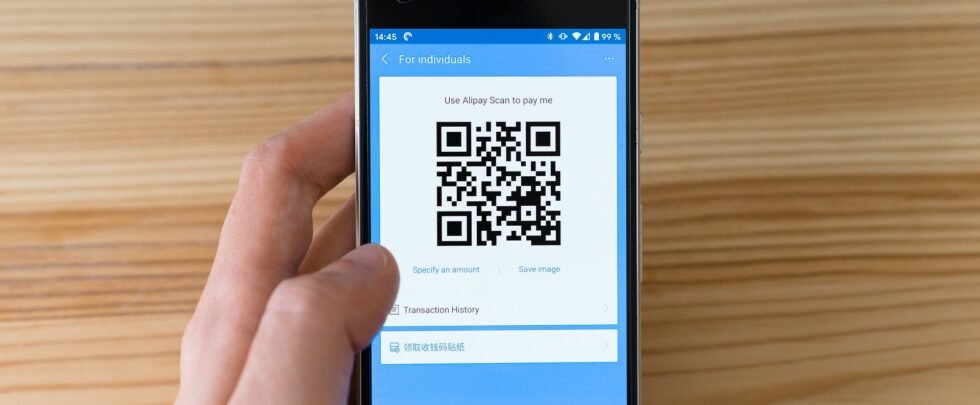

Example 2: Animal Rescue Increases Donations with Mobile Payments

An animal rescue organization decided to implement a mobile payment option at fundraising events and during online campaigns. The convenience led to a 25% increase in donations during these events, proving the power of offering multiple payment options.

“By tailoring payment options to fit donor preferences, nonprofits can enhance giving potential and reduce costs—creating a win-win for everyone involved.”

Expanding Donor Reach through Merchant Services for Nonprofits

Merchant services can do more than process donations; they can help expand your donor base and increase engagement. Here are a few methods:

- Text-to-Give Campaigns

Text-to-give campaigns allow donors to contribute by simply sending a text message. This mobile-friendly approach is particularly effective for reaching younger audiences and driving donations at events. - Recurring Donation Options

Recurring donations are a valuable asset for nonprofits, providing a steady income stream. Merchant services for nonprofits often offer tools for setting up and managing these recurring gifts. Be sure to promote these options, as small recurring donations can add up to a significant revenue source over time. - Customized Donation Pages with Multiple Payment Options

Customizing your donation page to include various payment options (credit, ACH, PayPal, etc.) and branding elements can create a seamless experience that builds trust and encourages giving. Platforms like Classy offer highly customizable pages, making it easier to convey your mission and impact.

Enhancing Transparency and Building Donor Trust

Donor trust is crucial for any nonprofit, and transparency in how donations are handled can strengthen this trust. Here are ways merchant services can support transparency:

- Display Transaction Fees on Donation Pages

Informing donors of transaction fees, and allowing them the option to cover these costs, demonstrates transparency and encourages them to give more generously. - Provide Clear Tax Receipts

Many merchant services for nonprofits have built-in functionality to generate and send automated tax receipts. This saves time and gives donors immediate confirmation, adding a layer of professionalism and accountability.

“Transparency fosters donor trust. When supporters understand how their funds are managed, they’re more likely to become recurring donors.”

The Future of Fundraising with Merchant Services for Nonprofits

The payment landscape is evolving, and nonprofits that embrace new merchant services can gain a competitive edge in fundraising. Here are three trends to watch:

- Cryptocurrency Donations

As cryptocurrency becomes more mainstream, some donors are looking for organizations that accept crypto as a form of donation. Platforms like The Giving Block specialize in helping nonprofits accept cryptocurrency, which can attract a younger, tech-savvy audience. - AI-Powered Donor Insights

Advanced merchant services platforms now integrate AI to analyze donor data, providing nonprofits with insights into donor behavior. This can help tailor engagement strategies, leading to increased donations and improved donor retention. - Integration with Social Media Platforms

Social media fundraising is on the rise, and integrating merchant services with platforms like Facebook and Instagram can help reach new donors directly. This streamlined process can increase donations, especially during viral campaigns.

Why Visit Nonprofit Freelancers?

If your nonprofit is looking to make informed decisions about merchant services, Nonprofit Freelancers is an invaluable resource. From strategic tips on selecting the right provider to expert insights on reducing fees, Nonprofit Freelancers connects you with the guidance and expertise you need to enhance your fundraising efforts. Visit their site to discover how tailored merchant services can help your nonprofit thrive.

Conclusion: Leveraging Merchant Services for Nonprofits to Maximize Impact

Selecting and managing merchant services for nonprofits is more than a financial decision; it’s a strategic step toward building a sustainable organization. By choosing services that align with your mission, reducing fees, and fostering trust through transparency, nonprofits can ensure that every dollar goes further. Whether you’re a small charity or a large nonprofit, leveraging the right merchant services can transform your fundraising efforts, helping you to focus more on impact and less on administrative costs.